cartoon by Tom Toles

(See Part 1 for my introduction to the topic of conservative political and economic trends.)

Let’s start with Paul Krugman, a Nobel Prize winning economist and prolific author who has a gift for saying complex things in terms that regular people can grasp. With no apologies, he is a dyed-in-the-wool liberal. In addition to his many books and scholarly papers, he has written extensively about some of these economic themes on the NYT opinion pages and blog. I thought his first blog post (pre-economic meltdown) set the tone well for the topics I am exploring:

Because of movement conservative political dominance, taxes on the rich have fallen, and the holes in the safety net have gotten bigger, even as inequality has soared. And the rise of movement conservatism is also at the heart of the bitter partisanship that characterizes politics today.

This post speaks to my overall topic -- the conservative movement's "long game" which is reshaping core assumptions about the role of government, fair labor practices, the social safety net and other key politico-economic factors -- and rewriting history (successfully, to some extent) about Social Security and the role of deregulation in fomenting the financial crisis, for example.

Krugman has written several articles and blog posts about the role deregulation played in getting us into the economic meltdown; this began with Reagan and accelerated on GWBush’s watch. He has also written on the importance of more government spending to get us out of the mess and debunked what he says are myths about government spending. He is especially concerned that cutting government spending threatens to repeat a mistake that stalled recovery during the Great Depression; here is more on that topic.

Supporting this premise, here is a recent piece from Bloomberg on how cutbacks in state government spending have slowed the recovery.

Income/wealth inequality and the shifting burden of taxation: Next, Mother Jones had a post just this past week, with excellent graphs illustrating points 1 and 2 from my Part 1 post. I am reproducing several here; I encourage you to take a look at the whole series, as they are very informative. (Apologies to those who struggle to understand graphs; some of this information is hard to present otherwise.)

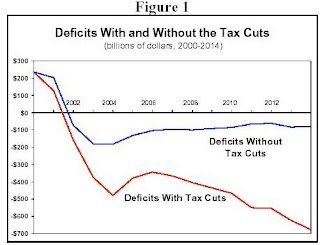

The DailyKos posted several times last year on income inequality and disproportionate benefits of proposed tax cuts, and here is a piece they linked to on income inequality. DailyKos also posted an excellent graph illustrating the deficit with and without tax cuts:

Source: Congressional Budget Office/DailyKos

They also posted this graph on the proportion of the deficit attributed to wars, tax cuts, TARP/recovery measures and the economic downturn itself.

Here is a WaPo graph from last year comparing who receives the benefits from the Bush tax cuts as compared with those originally proposed by Obama. Notably, this wasn’t a new topic in 2010; for example, the NYT wrote this in 2007 on tax cuts benefiting the wealthy. Bloomberg covered Warren Buffet on the wealthy paying more taxes and Newsweek wrote this a year ago on the topic. There is more on this subject from AmericanProgress.org.

Here’s another earlier article from Bloomberg on wealth inequity.

While on the subject of wealth inequity, I will add a note from my own personal experience. Early in my career, I worked on housing for the poor, and I remember it being a revelation to understand that many low-income people pay more for (often substandard) housing over the course of their lifetime than those who are much better-off and are able to own their own homes. This is because the poor have to pay rent every month of their life, and never build any equity. As onerous as 20-30 year mortgages can seem, there is an endpoint at which many mortgage holders will own their houses and the loan payments are done. If you are poor, rent is never done, until you die.

Corporate taxation: While these articles focus on individuals, the role of corporations in the shift of wealth and tax burdens is even more important. This recent Reuters article is about the number of corporations that don’t pay income taxes:

The Government Accountability Office said 72 percent of all foreign corporations and about 57 percent of

More than half of foreign companies and about 42 percent of

Here are some other reports from truth-out.org and dailykos on this topic. I found that the trend was not new; there were very similar report findings from 2008, for example. Here is more information on the decline of corporate tax revenue and on the percent of federal revenue that comes from corporations.

graph: nationalpriorities.org

Unemployment: Shifting to unemployment, The Atlantic wrote about the “jobless economy.” I also found this reference to a WaPo article positing that a jobless recovery may not be bad. (This is what I mean by things being said that, a generation ago, would have been labeled as extremist positions, but now barely elicit a reaction.)

I also want to refer to Patrick’s excellent post on economic factors, including unemployment and long-term unemployment. This stubborn unemployment provides fertile ground to sow discord and to blame President Obama for not solving problems that he did not create and that have become structurally embedded in the “new economy.”

Firedoglake had this interesting post on the GOP's budget cuts being a "war on jobs" -- predicting the loss of 700,000 jobs. This is the information that Cantor is studiously ignoring.

Krugman worries about the unemployed.

Weakening worker protections, unions and regulations: The Repubs are very openly using the economic crisis as an excuse to weaken environmental and other regulations, and to challenge unions.

Representative Issa has extended an invitation to business to let him know what regulations they want to get rid of; this is also playing out at the state level.

Robert Reich criticized the Republican attack on regulations on HuffPo, and here is a piece on the Republican attack on carbon emission regulations.

Alternet (also here) and many other blogs are covering the attempt to weaken labor. Here is an article from Bloomberg disputing Scott Walker's claims about the public worker unions in Wisconsin.

The attempt to take away hard-won workers' rights is so highly charged, so publicized and so brazen that I am sure all our readers are well aware of it; I will leave more on this subject to other posts.

Weakening Social Security and other programs:

Krugman criticizes proposals to weaken Social Security.

“And having invented a crisis, what do Social Security's attackers want to do? They don't propose cutting benefits to current retirees; invariably the plan is, instead, to cut benefits many years in the future. So think about it this way: In order to avoid the possibility of future benefit cuts, we must cut future benefits. OK.”

Talkingpointsmemo also posted on the current efforts to weaken Social Security.

DailyKos posted this on a new proposal to change federal Medicaid reimbursements into block grants, which would "inevitably" result in reduced coverage and services.

Government spending priorities: Here is a link to the Center on Budget and Policy Priorities on the overall federal spending breakdown, and some basic information from Wikipedia on the U.S. military budget.

Privatization of profit and socialization of risk: Here and here are links on the privatization of profit and the socialization of risk. In this article, the same theme is specifically connected to Big Oil and energy. (I plan to write a post on “Big Oil,” including who gets the profits and who absorbs the risks, in the coming months.) I will go a step further, and suggest that the issue is not only the privatization of profit from private enterprise, but the privatization of profit derived from public dollars; think Halliburton.

Corporate control and consolidation of the media: Patrick and others have written on corporate control of the media, and specifically about the growing influence of the Koch Brothers and Murdoch’s News Corporation; I will not include links now on this topic here, but I expect it will be explored further on PoliticalGates. However, here is a reminder of legislation (1996 Telecommunications Act) that made this possible by weakening anti-trust legislation that had prevented monopolization of media markets, and some basics on the consolidation of the media; another overview on this topic, with links. MediaMatters is an excellent source on this topic, and has a page on financial issues as well.

A different model: I appreciated the NYTimes interactive feature where people could submit their own suggestions for reducing the deficit; based on my own attempts, it is quite feasible to do so through cutting military expenditures and raising taxes on corporations and the wealthy, while maintaining the funding needed to support social, environmental and other programs that benefit this country and its citizens. There is no need to cut Social Security, Medicaid and Medicare to balance the budget.

I thought I would also add to the "conversation" a positive alternative to an economy based on boom and bust cycles, externalization of costs and weakening of worker and citizen protections; this website promotes a different economic model that challenges many economic assumptions.

Conservative voices: As you can see, the sources I’ve referenced range from liberal to non-partisan. To hear directly from conservatives on this subject, I am also linking to a “Conservative Economics 101” piece from The American Spectator. Here is another of their articles, calling for eliminating the corporate income tax.

Of course, I am aware that many PoliticalGaters are fans of Andrew Sullivan, who has a different take on many of these issues as well. While I do not always agree with Andrew on economic issues, I respect his intellect and devotion to facts, and I welcome learning more about his and other reasoned positions backed by data. I agree that running up huge deficits is not good fiscal policy; however, I am more Krugmanian in regards to the need for economic stimuli to get the economy on solid ground before cutting spending; I am also strongly supportive of the wealthy and corporations paying a larger share of the total tax revenue. And, I cannot help but remember that we were running surpluses during Clinton's second term, and the so-called conservatives couldn't wait to get rid of those surpluses through both tax cuts and unaccounted-for-wars. That's why I tend toward a more cynical interpretation of their motives, that they are really more intent on bankrupting the government so that it cannot fund programs that benefit the lower- and middle-class.

In the big picture, I keep coming back to this realization: imagine that, 30 years ago, someone openly proposed such dramatic shifts in wealth, tax burden, weakening of unions and safety net programs. That would have been considered lunatic-fringe extreme (well, think Ayn Rand). Now, it’s mainstream extreme (and, I guess, so is she).

I also find myself asking what allows the Republicans to be so brazen. There’s a psychological aspect, I think – tied to authoritarianism, which I suppose makes it easier to wield power without concern for “the little guy” or the damage done to people’s lives. There’s dogma espoused by Ayn Rand and her followers. Obviously, the Koch Brothers’ funded Tea Party is part of the story, as Patrick has illuminated in prior posts. FOX distortions of the news is another part. The Citizens United decision is a new factor that has tilted the playing field even more than before, allowing more manipulation of public perceptions and dissemination of disinformation than was possible before. These are topics for another day.

As you see, I have just scratched the surface. There is much drilling to be done. But, as a starting point, have at it – what do you think of these ideas? It seems that it should be possible to pull the curtain away from these conservative strategies so that everyone can see what is happening; I really hope that the progressives, liberals, and the middle can work together more effectively to advance a more constructive economic and political agenda.

Update: I just found this new post on Mother Jones, with an excellent graph that is very relevant to this topic.

No comments:

Post a Comment