by Blueberry T

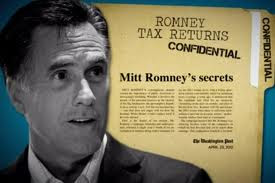

The saga

regarding Mitt and Ann Romney’s tax returns continues, as it should and will

until they disclose their tax returns, in keeping with the wishes of the American people and the precedent set by

Romney’s father and followed by all major

party candidates for the past 3 decades.

As Joe Biden and others have pointed out, George Romney also warned

against accepting only one year of returns, because “One year could be a

fluke, perhaps done for show.”

Ironically, Mitt Romney himself demanded that Ted Kennedy and Shannon O'Brien release more tax returns, when he ran against them in the Senate (1994) and Governor (2002) races in Massachusetts.

Many

people have weighed in with speculation about what the missing returns

show. Do they show that the Romneys paid no taxes for up to 10 years, as Harry Reid has claimed he was told by a

Republican Bain investor? Do they show that he shorted the Mormon Church on the 10% tithe? Do they show that the Romneys took an amnesty in 2009 for having illegally sheltered money in an offshore bank account? Do they show that the Romneys committed voter fraud when they claimed

they were living in their son’s basement so they could vote in

Massachusetts? Perhaps it is “all of the above,” or more? These questions could easily be answered, of

course, if the Romneys weren’t so obstinate, secretive and “small-minded” about

their tax returns.

I know

there is a lot of meat (or in Ann’s words, “ammunition”) in the 2010 return

alone, especially in regard to offshore accounts and investments, and tax experts

of all stripes have weighed in on some of these. However, as an ordinary citizen, I want to

point out something rather elementary that may have been covered by other

reports on the Romneys’ taxes, but if it was, I missed it – but I think it may

be quite important. I am referring here

to the Romneys’ 2010 tax return, which can be found here. (Note that even the 2010 return is incomplete because it does not have the

FBAR forms for his foreign bank accounts.)

Now, I

will preface the following with the disclosure that although I do my own taxes,

I am by no means an expert on tax law or tax preparation; far from it. Also, I don’t have a lot of investment

income, so I don’t have too much experience with the many tax issues associated

with the Romneys’ income taxes and the propriety of their tax avoidance

measures. I am not alleging any

impropriety, but simply looking at these returns at a very basic level, to try

to understand where the truth may lie. (Pun intended.)

With my

admittedly limited knowledge, what jumps out at me is that in 2010, the

majority of the Romney’s income was from capital gains. Of the $21.6M income that the Romneys

reported, $12.6M or 58% was from net capital gains. Of

course, we know that the preferentially low rate on capital gains is largely

the reason for the Romney’s federal tax rate of 13.9%, which is much lower than

the tax rate on income from earnings like wages, salaries and tips, for

example. (And of course it is not

subject to payroll taxes like FICA.) As

Paul Krugman points out here, the rate on capital gains

used to be much higher (during the Reagan, Bush 1 and Clinton Administrations,

for example), but was slashed to the current low rate during Bush II’s

Administration.

The

return also shows that the Romneys claimed a long-term capital loss carryover

of $4.84 million in 2010 (2010 return, Schedule D, Part 2, Line 14). Thus their long-term capital losses in 2009

(and likely 2008, maybe before) exceeded their capital gains, meaning they

would have entered a loss on their tax forms (Form 1040, line 13) in those

years, as compared to the $12.57M gain that they showed in 2010. The loss that can be entered is capped at

$3000 a year, so they carried over the rest.

This must

mean that line 13 was -$3000 in 2009, right?

Assuming their other income was roughly comparable, their total income

for 2009 would have been much lower - a

measly $9M, perhaps. Maybe less if interest, dividends and/or other business income was hit hard by the recession. I wonder how much they tithed and otherwise

donated to “charity” that year – was the tithe/charitable a meager $800,000, or closer to

the $2.98M in charitable deductions claimed in 2010? (The tithe is paid during the calendar year,

before their taxes are done, so would they necessarily know what the 10% figure

is before they made their donations?) If so, charitable deductions would be a larger percentage of

their total income, and would also make better sense of Romney’s odd comments

suggesting that his charitable contributions should be added to his tax

payment, and in doing so his total was always more than 20%.

(Huh? Mitt, that's not how tax rates are figured.)

If their total

“charitable” deductions were on a par with the $2.98M charitable deductions

they claimed in 2010, but their income was lower due to the capital loss, then it is very conceivable that they would have paid much

lower federal income taxes in 2009. Perhaps there are scenarios where it could be

zero, for example.

(I put

“charitable” in quotes because I have a hard time accepting that a mandatory

tithe paid to a major money-making enterprise, which profits from businesses such as gun sales, is truly charitable.

But that’s another topic. Here is

another comment on the subject of claiming the Mormon tithe as charitable

deduction. And as an aside, about half their charitable donations were via cash and

the other half via stocks, meaning that the IRS also lost out on any capital

gains taxes associated with the donation of those stocks. This is perfectly legal, of course.)

So I

guess my question is whether the Romneys’ income in 2009 (and probably 2008)

was more on the order of $8-10M or less, and if so, did their charitable

and other deductions make up a much larger percentage of the income than in

2010, thus resulting in much lower federal tax liabililty? Is it conceivable that there could have been

other deductions, offsets or income losses that would have brought the

liability down close to zero for 2008-9, as Harry Reid’s source alleged? It seems plausible.

Finally,

a short note on Ann Romney’s comment, while saying (using almost Palinesque

syntax), “there’s going to be no

more tax releases given,” that “…Mitt is honest. His integrity is, is

just golden.” (So was King Midas’.) Unfortunately for Ann, there is enough

evidence to the contrary in the public domain that documenting Mitt’s lies has

become a cottage industry (Googling

“Mitt’s lies” brings up 144 million results, including this, this, this and this).

So, Ann

is either wrong, or she buys into “lying for the Lord” as being

acceptable. Or she is a liar, too. Or all of the above. And of course this reminds me that Ann has said, “I truly want Mitt to fulfill

his destiny, and for that to happen, he’s got to do politics.” That suggests she is alluding to the White Horse Prophecy, which frankly gives me the

heebie-jeebies and certainly defies the principle of separation of Church and

State, as well as basic sanity.

Taxation is not my field of expertise and I am not alleging impropriety; I wrote this post because, like 63% of the American people, I want to know the answers

to all the questions that Mitt Romney refuses to answer about who he is, what

his values are, how he has amassed his wealth, and whether he is as dishonest

with his taxes as he is with his campaign.

As so many people have said, the mystery would go away if they would

simply #releasethereturns, so not doing so suggests that they have something to

hide. Ann says it is “ammunition.” Okay then, our assumptions that they are

hiding something must be at least somewhat legitimate. Personally, I would not vote for someone who

would not release their returns, because I believe it shows disrespect (read:

utter contempt) for the American voter to say “just trust me” instead of

providing us with the information we need to vet a candidate for President of

the United States

So,

right back at ya, Mitt: release the returns; put up or shut up.

No comments:

Post a Comment